Are Taxes High In Pennsylvania . Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania income and tax structure: By the percentage of all state. the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. 52 rows a couple of the various ways to measure state tax burdens include: Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the.

from itep.org

In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. pennsylvania income and tax structure: in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. By the percentage of all state. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. 52 rows a couple of the various ways to measure state tax burdens include: Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy.

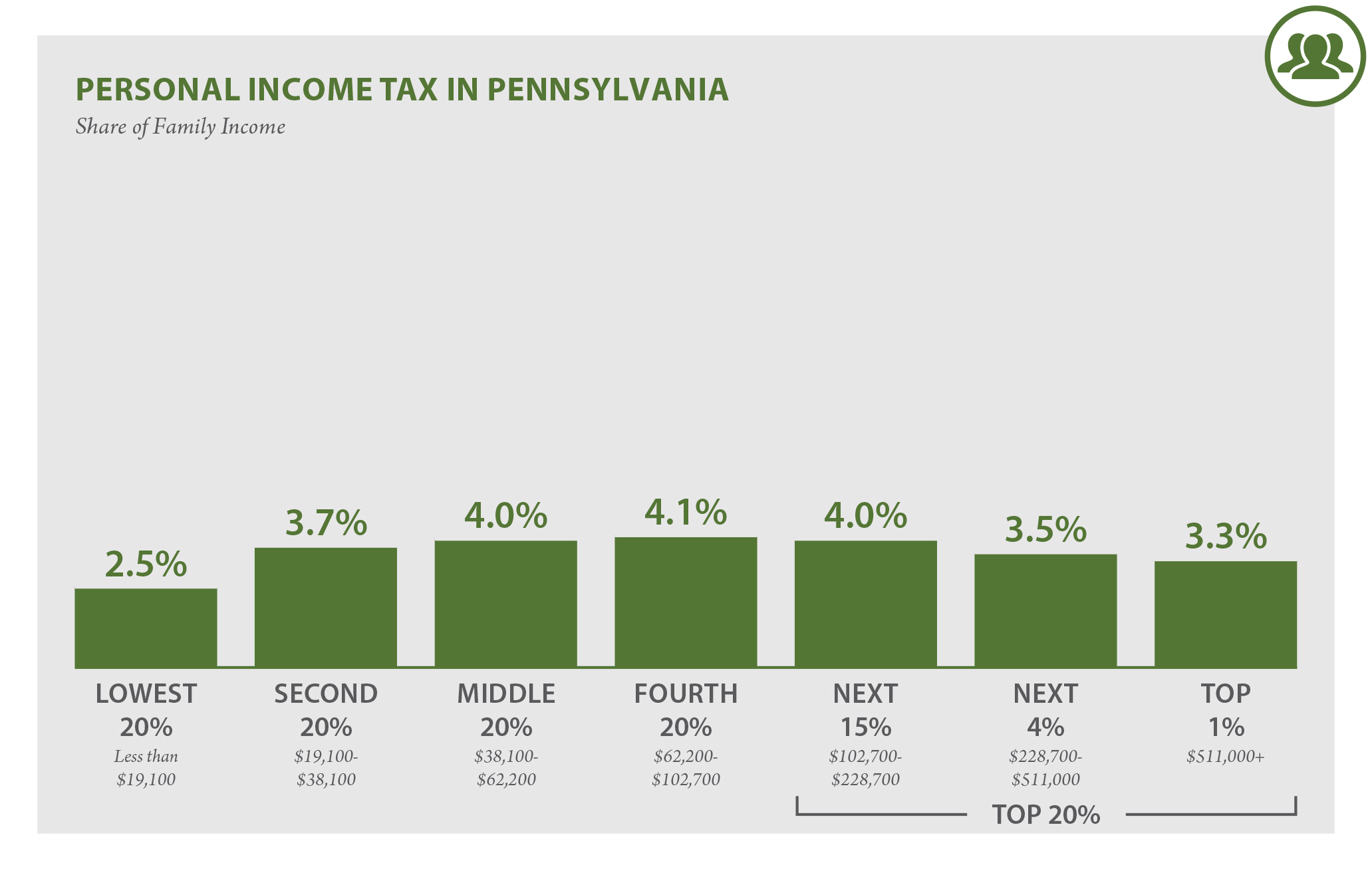

Pennsylvania Who Pays? 6th Edition ITEP

Are Taxes High In Pennsylvania pennsylvania income and tax structure: 52 rows a couple of the various ways to measure state tax burdens include: Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy. pennsylvania income and tax structure: the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. By the percentage of all state.

From rodgers-associates.com

Evaluating Where to Retire Pennsylvania Vs. Surrounding States Rodgers Are Taxes High In Pennsylvania In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. 52 rows a couple of the various ways to measure state tax burdens include: in fact, a recent study found that pennsylvania ranks among the top five states with. Are Taxes High In Pennsylvania.

From www.wnep.com

Pennsylvania personal tax returns deadline extended Are Taxes High In Pennsylvania pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. 52 rows a couple of the various. Are Taxes High In Pennsylvania.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Are Taxes High In Pennsylvania In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. 52 rows a couple of the various ways to measure state tax burdens include: Some pennsylvania state taxes are high compared to other states, including the. Are Taxes High In Pennsylvania.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Are Taxes High In Pennsylvania 52 rows a couple of the various ways to measure state tax burdens include: in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent.. Are Taxes High In Pennsylvania.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Are Taxes High In Pennsylvania in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. 52 rows a couple of the various ways to measure state tax burdens include: By the percentage of all state. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local. Are Taxes High In Pennsylvania.

From infogram.com

Pennsylvania's historical sales and tax rates Infogram Are Taxes High In Pennsylvania Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania income and tax structure: By the percentage of all state. 52 rows a couple of the various ways to measure state tax burdens include: In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. the governor is. Are Taxes High In Pennsylvania.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation Are Taxes High In Pennsylvania pennsylvania income and tax structure: Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. By the percentage of all state. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. the governor is proposing to raise the state’s personal income. Are Taxes High In Pennsylvania.

From chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu Are Taxes High In Pennsylvania pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. 52 rows a couple of the various ways to measure state tax burdens include:. Are Taxes High In Pennsylvania.

From www.madisontrust.com

What Is the Most Taxed State? Are Taxes High In Pennsylvania Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. pennsylvania income and tax structure: 52 rows a couple of the various ways to measure state tax burdens include: . Are Taxes High In Pennsylvania.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Are Taxes High In Pennsylvania pennsylvania income and tax structure: In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. in fact, a recent study found that pennsylvania ranks among the top five states with the. Are Taxes High In Pennsylvania.

From www.zippia.com

The 10 States With The Highest Tax Burden (And The Lowest) Zippia Are Taxes High In Pennsylvania By the percentage of all state. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. 52 rows a couple of the various ways. Are Taxes High In Pennsylvania.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates Are Taxes High In Pennsylvania Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy. By the percentage of all state. pennsylvania has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.34 percent. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. . Are Taxes High In Pennsylvania.

From www.thomsonreuters.com

Calculations for Pennsylvania local taxes Are Taxes High In Pennsylvania Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy. In 2023, pennsylvania income tax remains at a flat rate, simplifying calculations for taxpayers. By the percentage of all state. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania has a 6.00 percent state sales tax rate. Are Taxes High In Pennsylvania.

From mariqbrandea.pages.dev

Highest State Tax 2024 Fania Stefanie Are Taxes High In Pennsylvania Pennsylvania has a flat individual income tax rate of 3.07 percent, but some municipalities levy. By the percentage of all state. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. the governor is proposing to raise the state’s personal income tax from 3.07 percent today to. Are Taxes High In Pennsylvania.

From www.youtube.com

Pennsylvania Tax 2023 WalkThrough Example for Teaching Taxes Are Taxes High In Pennsylvania pennsylvania income and tax structure: By the percentage of all state. in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. pennsylvania has a 6.00 percent state sales tax rate and. Are Taxes High In Pennsylvania.

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Are Taxes High In Pennsylvania 52 rows a couple of the various ways to measure state tax burdens include: Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. In 2023, pennsylvania income tax remains at a flat rate, simplifying. Are Taxes High In Pennsylvania.

From taxfoundation.org

State Individual Tax Rates and Brackets Tax Foundation Are Taxes High In Pennsylvania in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. 52 rows a couple of the various ways to measure state tax burdens include: Some pennsylvania state taxes are high compared to other states, including the commonwealth's gas tax. In 2023, pennsylvania income tax remains at a. Are Taxes High In Pennsylvania.

From taxfoundation.org

Top State Tax Rates in 2014 Tax Foundation Are Taxes High In Pennsylvania in fact, a recent study found that pennsylvania ranks among the top five states with the highest tax rates in the. By the percentage of all state. pennsylvania income and tax structure: the governor is proposing to raise the state’s personal income tax from 3.07 percent today to 4.49 percent,. pennsylvania has a 6.00 percent state. Are Taxes High In Pennsylvania.